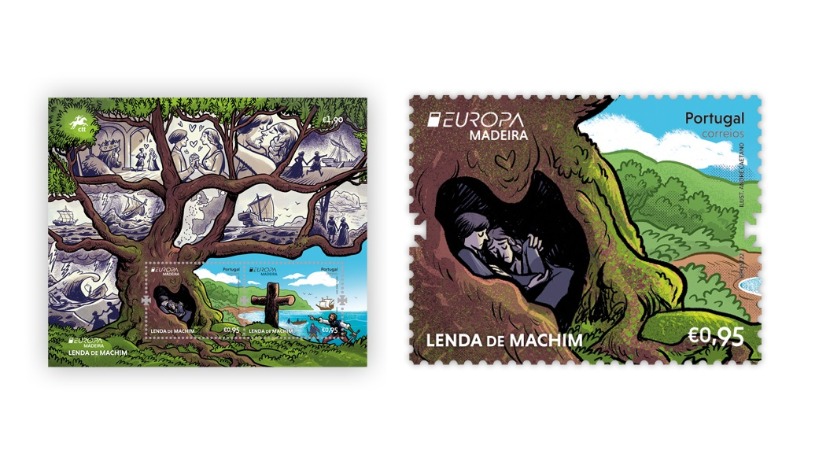

CTT – Correios de Portugal launched a new collection of stamps yesterday - a philatelic issue on the Histories and Myths of Europe, - with the municipality of Machico being highlighted through the Legend of Machim.

Posts published in “Tax Tips”

IRS 2021 – Procedures 1-7 – nº 7: Taxable Income Until June 30, taxpayers with an obligation to submit the IRS declaration must do so through the Internet. To submit the declaration, you must have an authentication password, sent by the Finance Department. It is the combination of the password…

IRS 2020 – Procedures 1-7 – nº 6: Filing Status Single, widowed and divorced taxpayers submit an individual return. Couples should also file an individual declaration but may elect to report jointly. Separated couples who are not divorced should each file singly. This is usually advisable since both spouses are…

IRS 2021 – Procedures 1-7 nº 5: Automatic “IRS” Reporting The Portuguese Tax Authority (“AT”) is making available Automatic “IRS” Reporting to millions of taxpayers in Portugal. The change is part of “Simplex”, a programme designed to reduce bureaucracy at all levels of government. The move has similarities to “PAYE”…

IRS 2021 – Procedures 1-7 – nº 4: Your “IRS” Declaration Filing Dates The tax year corresponds to the calendar year (01 Jan – 31 Dec). Fiscal Residents must submit tax returns by the following deadlines to avoid penalties. For the current fiscal year, declare between 01 April and 30 June.…

Do you live here more than 183 days per year? Then you have to deliver a tax declaration to the Tax Office. Here is how this is done, in seven parts (one coming out every week): IRS 2020 – Procedures 1-7– nº 3: Non-Habitual Residents Regime for Non-Habitual Residents The…

Do you live here more than 183 days per year? Then you have to deliver a tax declaration to the Tax Office. Here is how this is done, in seven parts (one coming out every week): IRS 2021 – Procedures 1-7 – nº 1: Residents Countries increasingly challenge former residents…

The vast majority of Foreign Residents share a common trait: most, if not all, of their livelihood comes from outside of Portugal. Great confusion and disinformation abound regarding such income from abroad. Before analysing the different requirements surrounding Individual Income Tax (IRS) in Portugal, it is useful to dispel some of the myths and establish a few of the basics regarding Portuguese taxation and the obligations of the Foreign Resident. So the first question to consider is: Who is required to become resident for tax purposes in Portugal?

Taxation of US citizens

The US government imposes income tax on US persons based on their worldwide income, not residency. The following are considered to be US persons for tax purposes:

- A citizen born in the United States or outside with at least one parent who is a US citizen;

- A naturalized citizen;

- A resident of the United States for tax purposes if they meet either the green card test or the substantial presence test for the calendar year;

- Any other person who is not a foreign person.

The proposal that the Government of Sweden sent to parliament to denounce the convention to avoid double taxation (CDT) with Portugal will be voted on 02 June. At the origin of this initiative is the fact that until now, Portugal has failed to ratify the protocol to the agreement signed by the two countries in May 2019.

Individual Taxable Income Declarations may be submitted in person at the local tax office (“Repartição de Finanças”), by post or over the internet. In all cases, the central reporting form, Modelo 3, should be used accompanied by the appropriate annexes for each category of income received. Net taxable income is…

Filing Status Single, widowed and divorced taxpayers submit an individual return. Couples should also file an individual declaration but may elect to report jointly. Separated couples who are not divorced should each file singly. This is usually advisable since both spouses are responsible for meeting all fiscal obligations under a…

Automatic “IRS” Reporting The Portuguese Tax Authority (“AT”) is making available Automatic “IRS” Reporting to millions of taxpayers in Portugal. The change is part of “Simplex”, a programme designed to reduce bureaucracy at all levels of government. The move has similarities to “PAYE” (Pay-As-You-Earn) in the United Kingdom where taxpayers…

Your “IRS” Declaration Filing Dates The tax year corresponds to the calendar year (01 Jan – 31 Dec). Fiscal Residents must submit tax returns by the following deadlines to avoid penalties. For the current fiscal year, declare between 01 April and 30 June. Unlike in the past, there is now…